Two main items in the news caught my attention. First, the one about money.

Despite the money insurers have paid out to Katrina victims over the past year, we learn now that the big insurance companies have just had their best year ever. The Times-Picayune reports that Allstate–much maligned in this part of the world for its stingy payouts to their customers–earned a whopping $5 billion last year. State Farm’s profits were up 65 percent. St. Paul Traveler’s earnings rose sixfold in the fourth quarter, and American International Group (AIG) saw its profits rise eightfold. Profits are expected to be high in 2007 too.

Anyone smell a rat? Listen to some of these companies and you would think they are about to go belly-up and cannot afford to insure people in this part of the world any longer. (As obscene as the gas company profits are–and we’re all stunned to learn of the billions they earn at a time when the gas prices keep going up–at no point do they suggest they ought to quit selling their product. Insurance companies do however.)

People who know tell us that insurers are themselves insured, that they do not bear the full weight of liability for the properties they insure, and that if a catastrophe hits, they are protected. Otherwise, one big hurricane could wipe them out. Okay, makes sense. And, apparently, that’s what happened.

J. Robert Hunter, director of insurance for the non-profit Consumer Federation of America, is coming down hard on the insurance companies. Hunter says the reason their profits are so high is that they have used Katrina and other major hurricanes to justify “overpricing insurance, underpaying claims and reaping unjustified profits” at the expense of homeowners and business owners. He expects these companies will continue to prosper because they are increasing costs, upping deductibles, and excluding high risks from the policies.

Eileen Frank, a former resident of our state and an insurance broker in New York, disputes the insurance industry’s claim that they have already paid out 95 percent of the claims made since Katrina. Many others are still pending, she says, and cites personal examples of being shunted from one adjuster to another with the people she was trying to help.

Frank gave an example of a homeowner whose insurance she handled recently. Prior to Katrina, he paid $2,000 a year for insurance; now it’s three times that. Worse, the policy now has a deductible for wind damage in an amount equal to 5 percent of the house’s value. That is, if my house is worth $200,000 and we have a hurricane, the first $10,000 of damage is my problem.

Not to be overly cynical, but apparently, here is how it works: if you will live in a no-risk area, won’t expect much from me and my company, and are willing to pay whatever I ask in premiums, I will insure your home. And since lending companies will not trust you with their money to rebuild your home without proper insurance, you may not have much choice but to buy it.

The other item came from USA Today and concerned Bud Selig, the CEO of professional baseball. He makes $12 million a year, the article stated, and apparently is a health nut. That is, at first glance.

Each morning, Selig spends maybe an hour on his exercise bike and goes through a workout. His breakfast is a glass of orange juice and a banana. At the office, he has a cup of hot tea. Impressive? Wait.

For lunch–every day–he walks down the street and buys a big ball-park hot dog. And throughout the day, he drinks as many as nine–nine!–carbonated soft drinks.

They didn’t say what he has for dinner.

That’s all. I was just struck by the incongruity of that. He does some things so right and some things so bad wrong.

Back to the business about the insurance companies.

The best question ever–ever!–raised about my preaching was voiced by a 7 year old, and it applies here.

I was sounding forth on some complicated bit of theology or church history or something, some issue most in the congregation found tedious and difficult-to-follow, when little Holly Martin leaned over to her mom Lydia and asked, “Mother, why does Dr. Joe think we need this information?”

Every preacher ought to be stopped halfway through his sermon and made to answer that question. What is the point of this? What do you want us to do? (They asked that of John the Baptist in Luke 3 and of Peter in the middle of his Pentecostal sermon, Acts 2:37, so you’d have good biblical precedent for doing it!)

So, why do we want you to have this information on the insurance companies? Answer: I’m not sure. But it just seems that folks outside our area ought to be aware of what’s happening.

Finally….

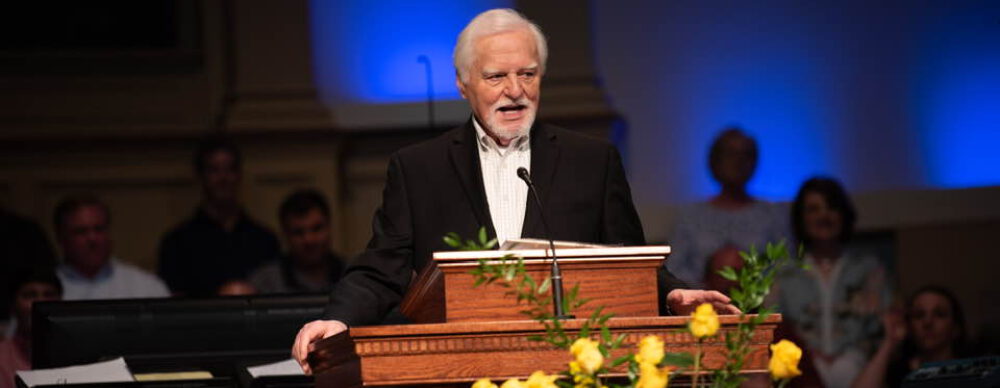

I spoke Monday night to the annual meeting of about 20 or 25 executive directors of SBC state Baptist foundations, meeting in Alexandria. At the end of my presentation–which was mostly stories about people in our part of the world–several had questions.

“My church has some money to send to a church down there. We were helping a church in the Slidell area, but they don’t need us any more. Do you?” I said, “I can give you the names of 25 churches right now that would welcome any help you want to send.”

Another said, “Other than praying for you and sending money, is there anything else you need?” I said, “Volunteers. We’re going to be needing teams of workers from your churches for years to come.” I told of Operation NOAH Rebuild, of Baptist Crossroads Project, and some of the other critical rebuilding and evangelizing ministries going on down here.

We have been blessed by gifts and prayers and volunteers from all over America, particularly from religious groups, and especially Baptist churches.

I am delighted to announce that hundreds and hundreds of volunteers are still heading this way. The river of assistance and encouragement shows no sign of abating. For which we are eternally grateful.

Regardless what insurers and governments do, God’s people are still getting it right.